Improved anchoring of people’s expectations for inflation, which makes the expected inflation term in the Phillips curve more stable, can account for both observations. This development is important because it indicates that structural changes in the economy have not eliminated the inflationary pressure of gap variables. Over the same time, a positive link between the level of inflation and the output gap has emerged, reminiscent of the original 1958 version of the Phillips curve. inflation and the output gap has weakened in recent decades. It is mainly here that prices will rise, further enriching those who already own such assets.The link between changes in U.S. A good part of the rest will go into stocks, bonds and real estate. Yes, some will be spent on services, house repairs and other expenses that were neglected. Much of the Biden money won’t go to China, but toward savings to cover future rent, mortgages, utilities, and debt repayments. What they lack is confidence and security. Short of that, US households are not suffering from a shortage of products. War is always inflationary a war with our largest goods supplier would be an inflation nightmare. But the only real inflationary danger comes from those fanning the flames of war with China. There may be some delayed deliveries, and some price increases due to higher shipping costs and higher wages in China. Such firms will not alienate their customers by jacking up prices to exploit a little extra demand. Plus, there is no longer a tendency for oil-price fluctuations to feed through to wages and other prices, because American jobs now are mainly in services, where the price of labour is the price you pay.īut won’t China now take advantage of high US demand to push up prices? No, because Chinese firms fear losing market share to other countries, and because its economic ethos prizes not profit maximization but social stability, steady production growth, and cost reductions through learning and new technologies.

#Philips curve full#

Since full employment had never been the culprit, the full employment of the late 1990s and in the run-up to the covid pandemic did not bring back inflation. Meanwhile, the forces that drove up US consumer prices after 1970-including dollar devaluations, oil-price spikes and cost-of-living adjustments for factory workers-all disappeared. The ensuing collapse of world commodity prices set the stage for China to emerge as the world’s leading purveyor of manufactured consumer goods. From the early 1980s, the US dollar began to rise, crushing America’s Midwest industrial base and trade unions. The answer can almost be summed up in a single word: China. I pointed this out in a 1997 article titled ‘Time to Ditch the NAIRU’. The relationship is not vertical or downward-sloping, but flat it doesn’t exist, if it ever did. From the early 1980s-and more so from the mid-1990s onward-no inflation could be found, and lower unemployment did not tend to bring it on. Reality, though, has obliterated the Phillips curve. Summers, I’m fairly sure, has more confidence in US capitalism than this view implies and yet, he always hewed close to this skittish school of thought.

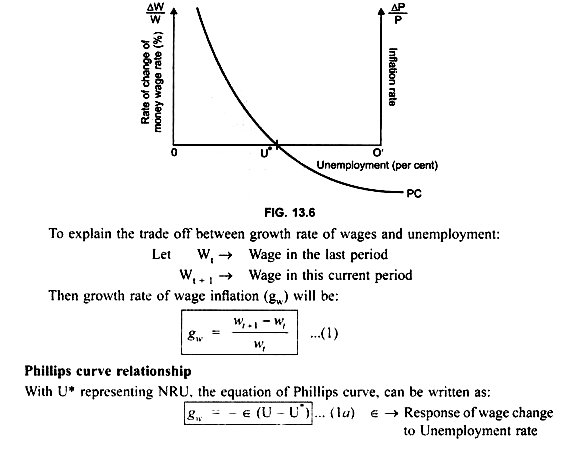

The implication was that any attempt to reduce unemployment below a ‘natural rate’ or ‘non-accelerating inflation rate of unemployment’ (NAIRU) would produce hyperinflation. For about 25 years after that, the dominant economic thinking held that it was not a downward-sloping curve but a vertical line, at least ‘in the long run’. But that curve has had a rough ride since 1969.

By old-fashioned Phillips-curve logic, the new ‘stimulus’ could drive the unemployment rate down to full employment and the inflation rate up from 0.6% in 2020 to at least 2-3%.

Those receiving relief payments are mostly at the bottom of the income distribution, and thus should, in theory, spend more and save less of it. Moreover, the official unemployment rate, at 6.2%, is not terribly far from the 4% level usually taken as ‘full employment’.

0 kommentar(er)

0 kommentar(er)